44 coupon rate and ytm

Treasuries - WSJ News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

Coupon rate and ytm

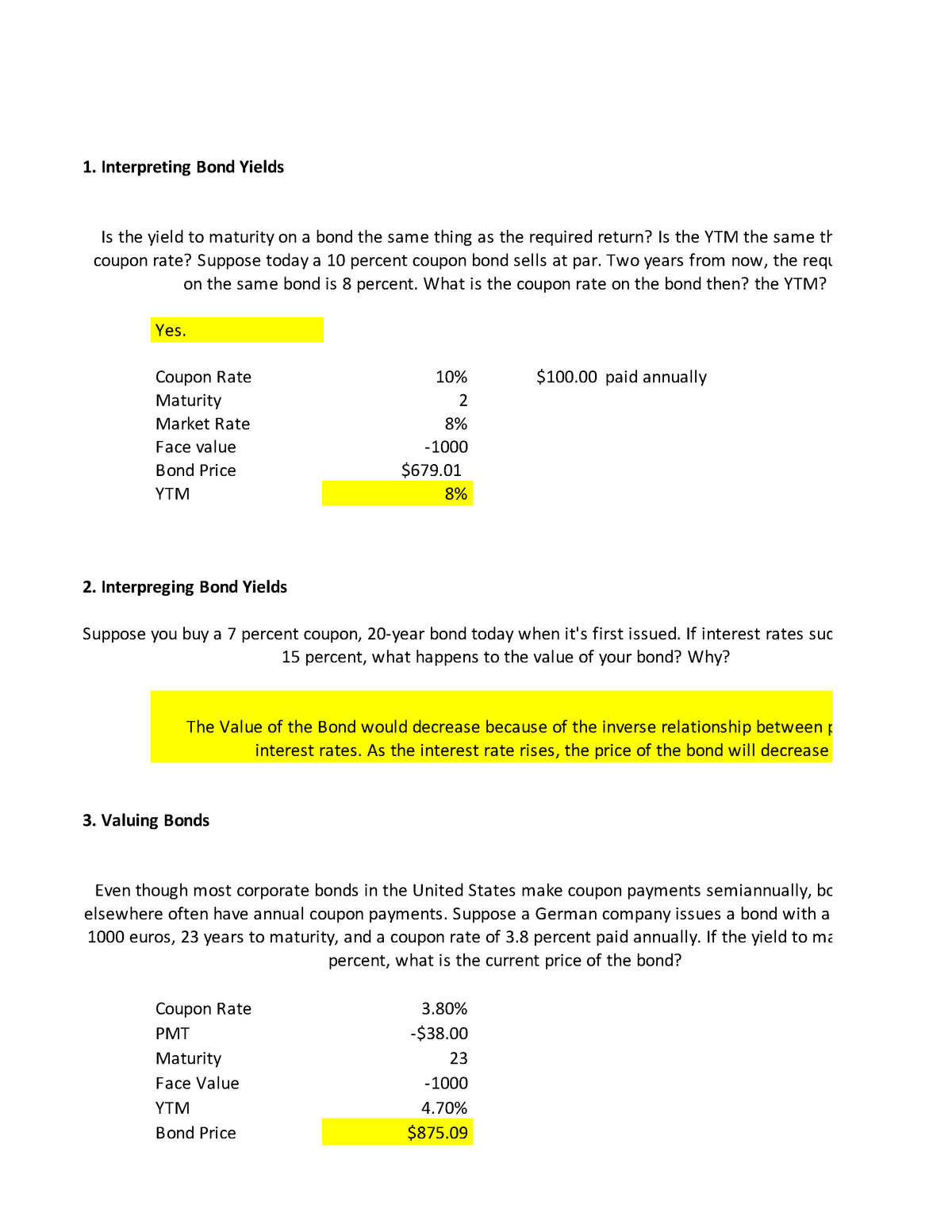

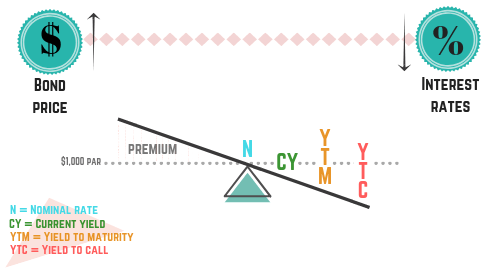

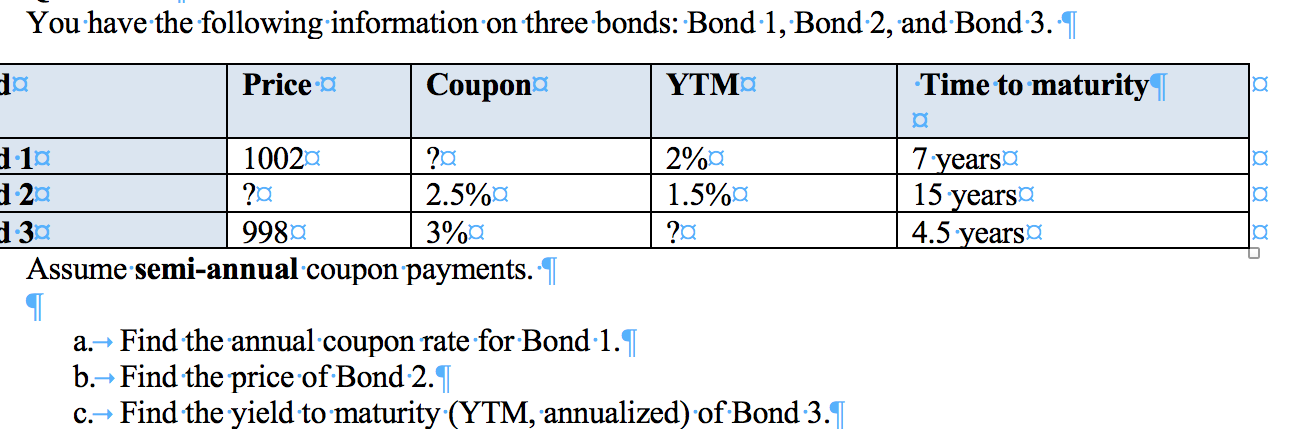

What Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered ... Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Current Yield vs. Yield to Maturity - Investopedia Oct 12, 2022 · For example, a bond with a $1,000 par value and a 7% coupon rate pays $70 in interest annually. Current Yield of Bonds . ... its current yield and YTM are lower than its coupon rate.

Coupon rate and ytm. Yield to maturity - Wikipedia The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. Current Yield vs. Yield to Maturity - Investopedia Oct 12, 2022 · For example, a bond with a $1,000 par value and a 7% coupon rate pays $70 in interest annually. Current Yield of Bonds . ... its current yield and YTM are lower than its coupon rate. Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered ...

Post a Comment for "44 coupon rate and ytm"