43 yield to maturity of coupon bond

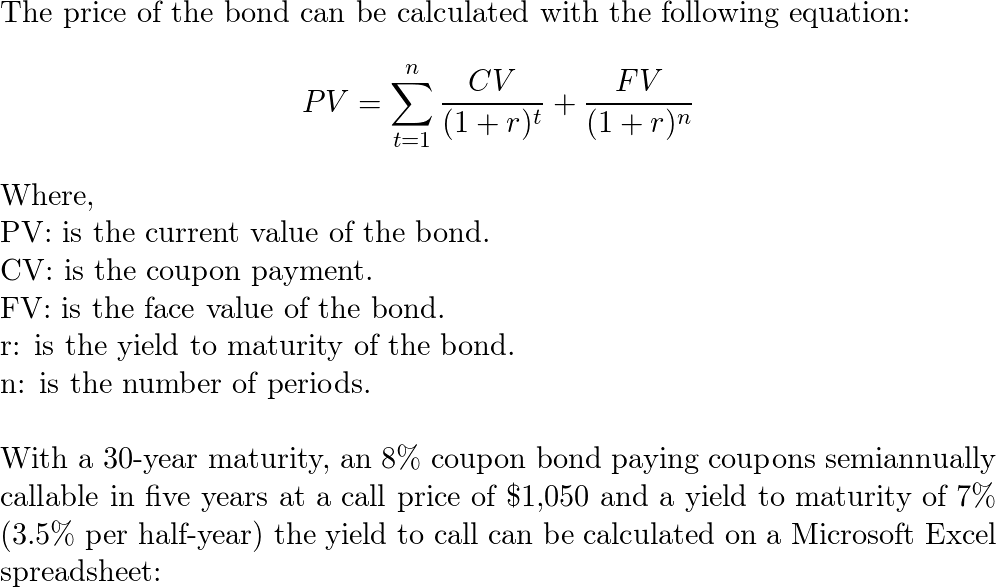

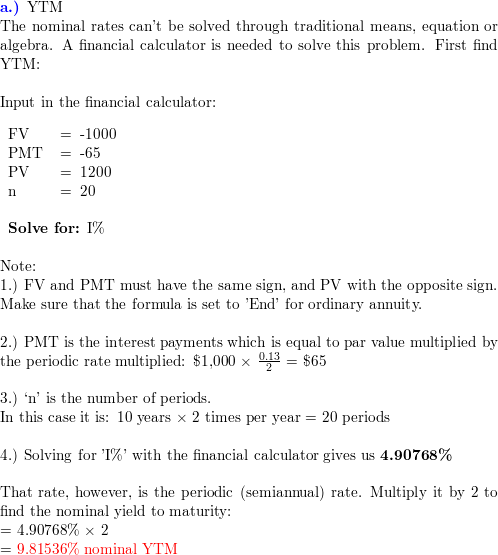

Yield to Maturity vs. Coupon Rate: What's the Difference? When investors consider buying bonds they need to look at two vital pieces of information: the yield to maturity (YTM) and the coupon rate. Understanding Coupon Rate and Yield to Maturity of Bonds Do note, however, that if your account is entitled to tax exemption then the calculation for coupon payment will exclude the final taxes. Yield-to-Maturity The Yield to Maturity is a rate of return that assumes that the buyer of the bond will hold the security until its maturity date and incorporates the rise or fall of market interest rates.

Yield to Maturity (YTM) - Definition, Formula, Calculation ... YTM considers the effective yieldEffective YieldEffective yield is a yearly rate of return at a periodic interest rate proclaimed to be one of the effective measures of an equity holder's return as it takes compounding into its due consideration, unlike the nominal yield method.read more of the bond, which is based on compoundingCompoundingCompound...

Yield to maturity of coupon bond

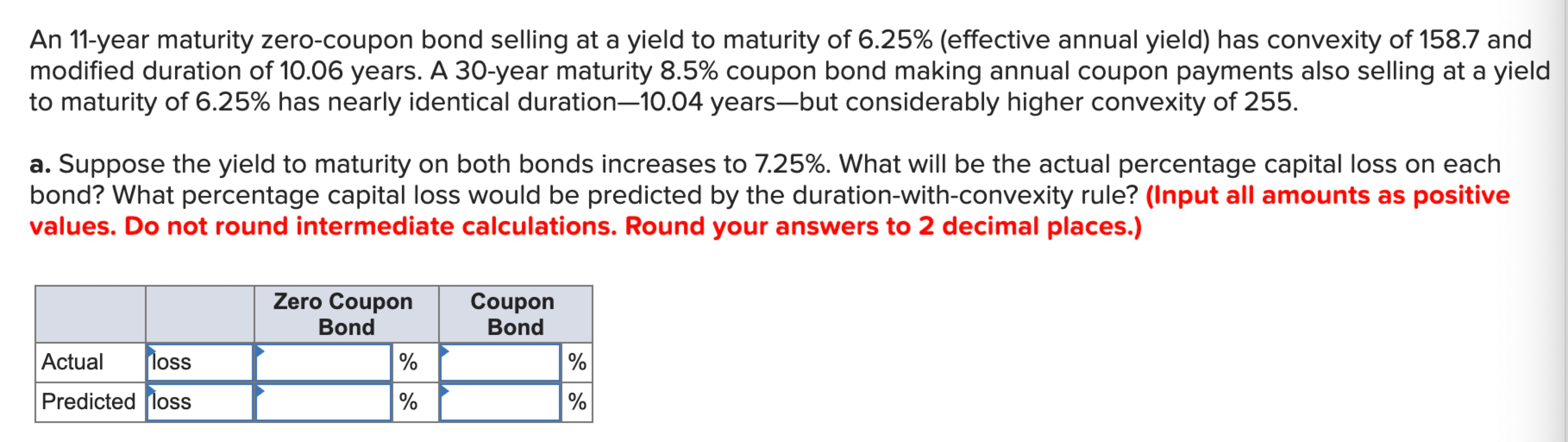

How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield to maturity (YTM) is an important metric used in bond markets that describes the total rate of return that is expected from a bond once it has made all of its future interest payments and repays the original principal amount. Zero-coupon bonds (z-bonds), however, do not have reoccurring interest payments, which distinguishes YTM calculations from bonds with a coupon rate . Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon payments) to equal the current...

Yield to maturity of coupon bond. Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon payments) to equal the current... How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield to maturity (YTM) is an important metric used in bond markets that describes the total rate of return that is expected from a bond once it has made all of its future interest payments and repays the original principal amount. Zero-coupon bonds (z-bonds), however, do not have reoccurring interest payments, which distinguishes YTM calculations from bonds with a coupon rate .

Post a Comment for "43 yield to maturity of coupon bond"