40 how to find the coupon rate of a bond

home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data › eneasyJet | Cheap flights ️ Book low-cost flight tickets 2023 Find Cheap Flights with easyJet Over the last 25 years easyJet has become Europe’s leading short-haul airline, revolutionising European air travel by allowing passengers to book cheap flights across Europe’s top flight routes, connecting more than 30 countries and over 100 cities.

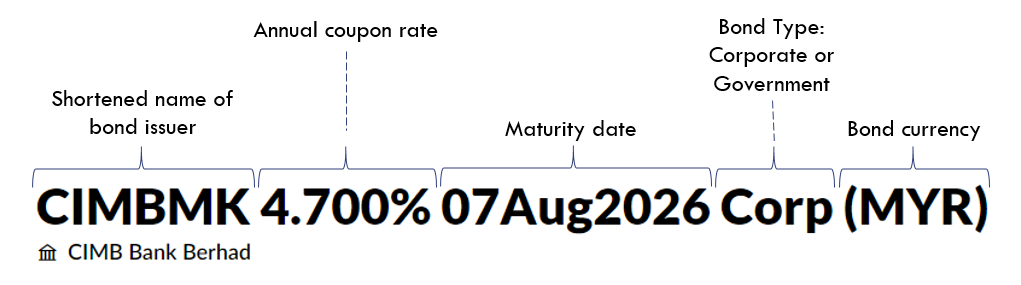

› ask › answersHow Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · A bond's coupon rate is simply the rate of interest it pays each year, expressed as a percentage of the bond's par value. (It's called the coupon rate because, in days of yore, investors actually ...

How to find the coupon rate of a bond

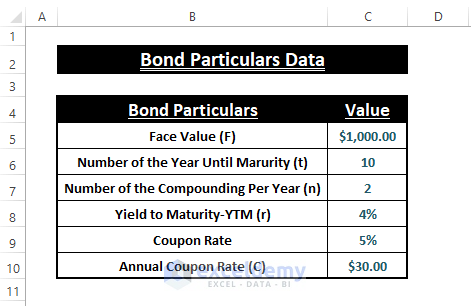

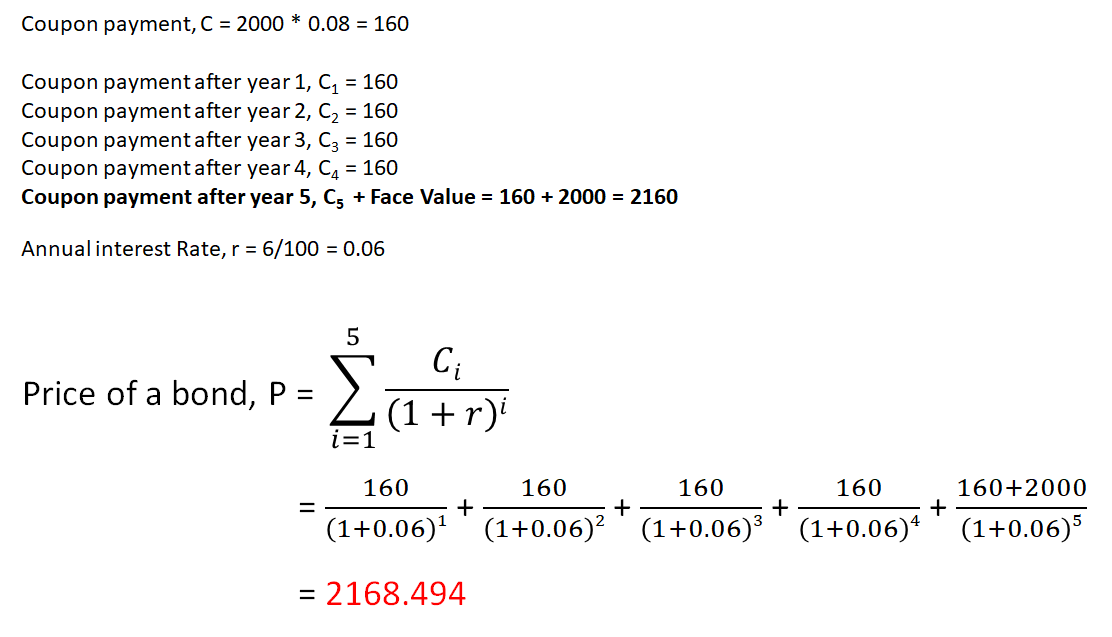

› what-is-the-coupon-rateWhat Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bondholders will receive $30 in interest payments each year, generally paid on a semiannual basis. abcnews.go.com › technologyTechnology and Science News - ABC News Oct 17, 2022 · Get the latest science news and technology news, read tech reviews and more at ABC News. › finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

How to find the coupon rate of a bond. : Pharmacy, Health & Wellness, Photo & More for You Your go-to for Pharmacy, Health & Wellness and Photo products. Refill prescriptions online, order items for delivery or store pickup, and create Photo Gifts. › finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... abcnews.go.com › technologyTechnology and Science News - ABC News Oct 17, 2022 · Get the latest science news and technology news, read tech reviews and more at ABC News. › what-is-the-coupon-rateWhat Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bondholders will receive $30 in interest payments each year, generally paid on a semiannual basis.

Post a Comment for "40 how to find the coupon rate of a bond"