45 fixed coupon note term sheet

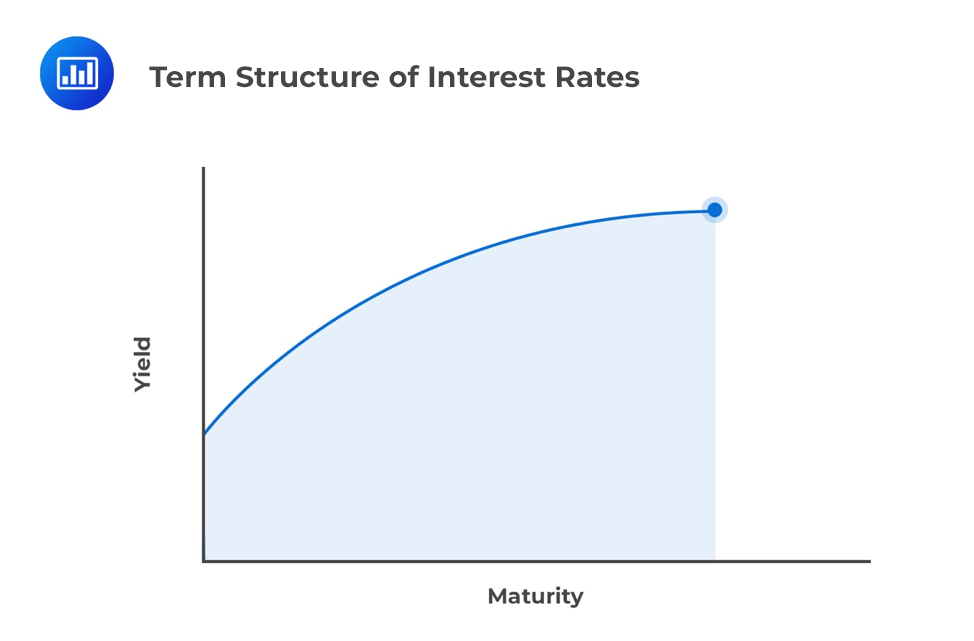

Treasury Bonds | AOFM Treasury Bonds are medium to long-term debt securities that carry an annual rate of interest fixed over the life of the security, payable semi-annually. Indicative yields for Treasury Bonds are published by the Reserve Bank of Australia. Treasury Bond lines. Coupon and Maturity (click for term sheet) Structured Products Basic Products, sample term sheet and pricing Term Sheet. This 5-year SGD Equity-Linked Structured Deposit ("SD") offers depositors an opportunity to have yield enhancement linked to the relative performance of an equity index and a bond index. An Interest Rate of 4.00% per annum* is payable if the return of the equity index is greater than or equal to the return of the bond index ...

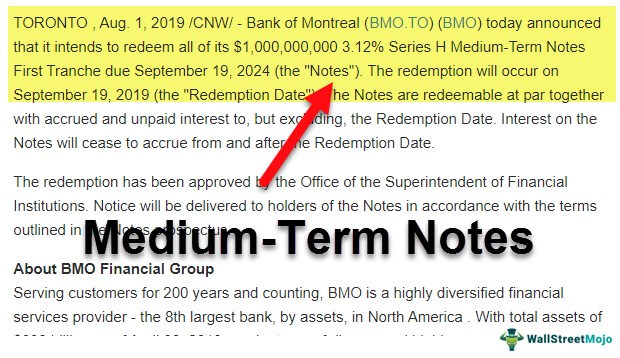

PDF The Bank of Nova Scotia Extendible Fixed Rate Coupon Notes Final Term Sheet Extendible Fixed Rate Coupon Notes Final Term Sheet Issuer: The Bank of Nova Scotia (the "Bank") Issue: The Bank of Nova Scotia Extendible Fixed Rate Coupon Notes extendible semi-annually at the Bank's option starting May 26, 2024 to a maximum term of approximately 7 years (the "Notes"). The Notes will be direct senior unsecured and ...

Fixed coupon note term sheet

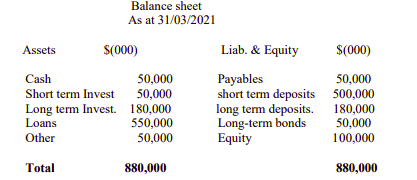

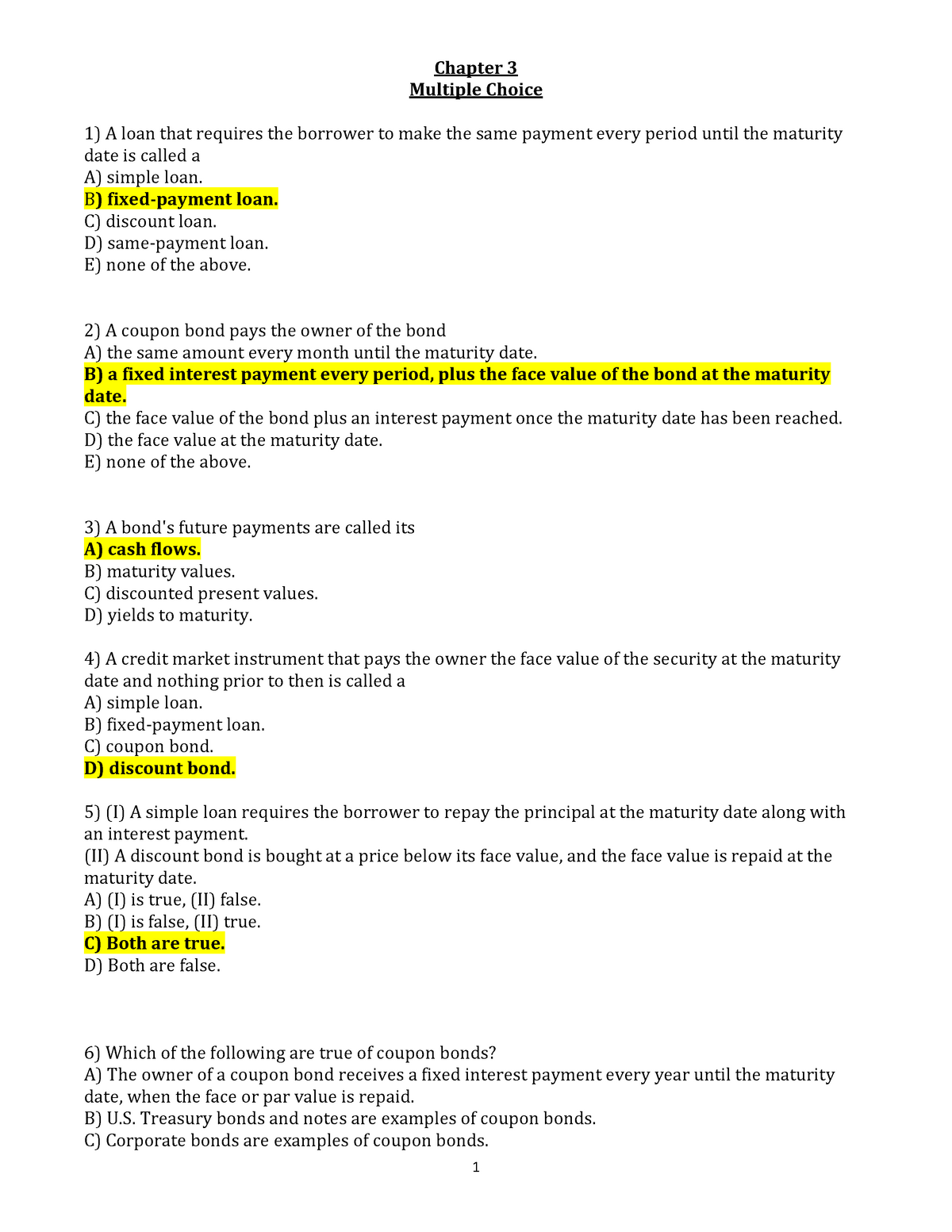

› balance-sheet-examplesBalance Sheet Examples | Explanation and Examples of ... - EDUCBA Definition of Balance Sheet Examples. Balance sheet is a key statement which forms as a part of the financial statements, which reports the financial position or the book value of the net worth of the company as at a specified date in the current year as well as the previous year, and it may be presented for a standalone entity or for the group- companies on a consolidated basis. PDF Callable Fixed Rate Notes - RBC Capital Markets Fixed Rate Callable Notes have "fixed" interest rates for their entire term. These notes offer investors higher yields versus vanilla benchmarks. Issuer has the right to redeem the notes early in exchange for coupon payments that are potentially higher than non-structured bonds of similar credit quality. Step-Up Callable Notes Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

Fixed coupon note term sheet. Definition Equity-Linked Note (ELN) - Investopedia An equity-linked note (ELN) is an investment product that combines a fixed-income investment with additional potential returns that are tied to the performance of equities. Equity-linked notes are... › terms › pPar Value Definition - Investopedia Jun 22, 2022 · Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. Par ... ELN -- Equity Linked Note -- Definition & Example | InvestingAnswers An ELN is a principal-protected instrument generally intended to return 100% of the original investment at maturity, but deviates from a typical fixed-coupon bond in that its coupon is governed by the appreciation of the underlying equity. An ELN has fixed-income features, like principal protection, as well as equity market upward exposure. Term Note: Definition & Sample - ContractsCounsel A term note, or a term loan, is a type of loan in which the borrower receives a lump sum of money up front, but most adhere to predetermined borrowing terms. Typically, before receiving the term note, a borrower will agree to repay the loan based on a fixed repayment schedule with either fixed or floating interest.

Preliminary Term Sheet - SEC The Floating Rate Notes (the "Notes") are medium-term notes issued by UBS AG that pay interest quarterly in arrears at a rate per annum (the "Applicable Interest Rate") equal to the sum of USD 3-Month LIBOR plus a Spread of 1.25% per annum (the "Floating Interest Rate"); provided that if on the relevant Coupon Determination Date (i ... Understanding structured notes - MoneySense A structured note is a debt obligation of the issuer of the structured note. The issuer of the structured note usually pays interest or returns to investors during the term of the notes. The interest paid may be a fixed coupon or calculated according to a formula which is linked to one or more underlying reference asset (s) or benchmark (s). PDF The Bank of Nova Scotia Extendible Fixed Rate Coupon Notes Final Term Sheet Issue: The Bank of Nova Scotia Extendible Fixed Rate Coupon Notes extendible semi-annually at the Bank's option starting July 28, 2023 to a maximum term of approximately 5 years (the "Notes"). › mortgage › mortgage-ratesMortgage Rates - Today's Rates from Bank of America Mortgage rates valid as of 12 Sep 2022 02:48 p.m. Central Daylight Time and assume borrower has excellent credit (including a credit score of 740 or higher). Estimated monthly payments shown include principal, interest and (if applicable) any required mortgage insurance.

Simple Math Terms for Fixed-Coupon Corporate Bonds - Investopedia Coupon: This refers to the annual amount of interest a bond pays out and is often expressed as a percentage of the bond's face value. This means a $1,000 corporate bond that has a fixed 6% coupon... Finance | Fixed Coupon Note A note that provides the investor with fixed coupon payment over the couse of its life, typically ranging from two to five years. The stable income is a source of protection against a low to moderate decline in the reference rate (such as an index , ETF , etc.) over the period defined by the the note's tenor (term). › udocsUdocs - University of Western States Welcome the Udocs, the intranet for University of Western States documents and policies. Faculty/staff resource document links marked * require a uws.edu email login.Student resource document links marked ** require a uws.edu email login. Tuition and Fee Schedules Tuition and Fee Schedules 2017-2018Tuition and Fee Schedules 2018-2019Tuition and Fee Schedules 2019-2020Tuition and Fee Schedules ... Is a convertible note a loan? | Note Brokering What is a convertible note term sheet? ... Concluding long-term borrowing with a low fixed interest rate. Postponement of dilution of votes. Increasing the overall level of indebtedness. ... The average interest rate coupon on convertible debt in 2021 is 1.41%, which is the lowest record. On average, this year's issuers will have to convert ...

PDF The Bank of Nova Scotia Extendible Fixed Rate Coupon Notes (Bail-inable ... Issue: Extendible Fixed Rate Coupon Notes, extendible semi-annually at the Bank's option starting April 22, 2020 to a maximum term of 10 years (the "Notes"). The Notes will be direct senior unsecured and unsubordinated liabilities of the Bank ranking pari passu with all other senior unsecured and unsubordinated debt of the Bank.

PDF The Toronto-Dominion Bank Fixed Rate Senior Notes Final Term Sheet - td.com Coupon: Fixed at 2.260% per annum, interest payable in equal semi-annual payments in arrears on January 7 and July 7 of each year, commencing July 7, 2022, subject ... The delivery of this Term Sheet, the issue of the Senior Notes and any sale of the Senior Notes

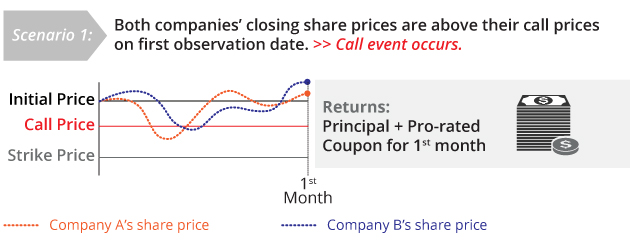

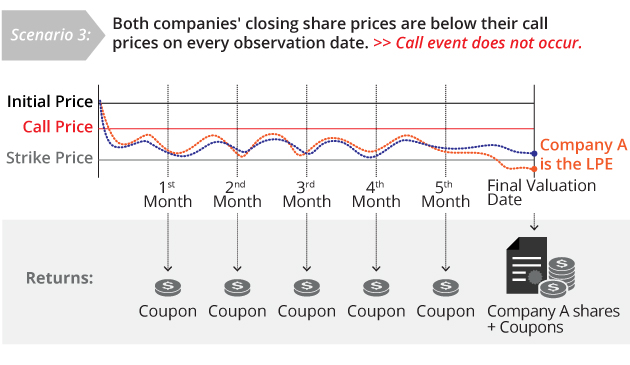

Fixed Coupon Notes (FCNs) | DBS Private Bank FCNs are a type of equity-based structured note. They provide regular coupon payments to the investor regardless of market conditions. Investors can either get their principal back in full plus coupons, or they are " put " (or contractually obligated to buy at a specific price) the " least performing equity " (or worst performing stock ...

Fixed Coupon Notes | DBS Treasures FCNs are a type of equity-based structured note. They provide regular coupon payments to the investor regardless of market conditions. Investors can either get their principal back in full, plus coupons, or they are "put" (or contractually obligated to buy at a specific price) the worst performing stock in a basket of equities, plus the ...

Equity-Linked Notes (ELN) Best Practices - Confluence Fixed Coupon and Initial Equity Price can be sourced from the term sheet or trade ticket. Annualized Coupon Rate = Fixed Coupon Rate * Initial Equity Price Input the calculated variable rate using Add Variable Rate. Effective Date (1109): populate with Dated Date from the SMF

PDF Structured Notes - Asia-Plus "Fixed Coupon Notes (FCNs)"is a type of structured notes that underlied on assets such as individual stock, stock indexes etc. Investing in FCNs, investors can invest between 1-6 months and get monthly coupon. One of significant features of FCNs is an autocallable feature, a right for issuer to make early redemption. FCNs

macabacus.com › valuation › lboCapital Structure of an LBO - Macabacus Can be split into Term A (shorter term, higher amortization) and Term B (longer term, nominal amortization, bullet payment) Generally, no minimum size requirement; Amortizes over the life of the loans; Generally, no prepayment penalties : High-Yield and Subordinated Debt : Typically 20-30% of capital structure; Generally unsecured ; Fixed coupon

Equity-Linked Note (ELN) - Overview, Features, Benefits An equity-linked note (ELN) refers to a debt instrument that does not pay a fixed interest rate. Instead, it is a type of structured product whose return is linked to the performance of its underlying equity. The equity tied to an equity-linked note can be a security, a basket of securities, or a broader market index.

› ask › answersCommon Examples of Marketable Securities - Investopedia Jan 18, 2022 · Much like a bank loan, a bond guarantees a fixed rate of return, called the coupon rate, in exchange for the use of the invested funds. The face value of the bond is its par value .

PDF Research Piece ELN v22 - University of Illinois Chicago from a standard fixed-coupon bond in that its coupon is determined by the appreciation of the underlying equity. There are many groups of investors who incorporate ELN's into their investment strategies, including: n Conservative, risk averse equity investors or intermediate-term fixed-income investors.

What are Fixed Coupon Notes? - addx.co Fixed Coupon Notes (FCNs) are equity-linked structured notes that seek to pay regular distributions at pre-defined intervals, where the payment of coupons is independent of the price movement of the underlying securities. It is a way for investors with a specific view on the price movement of the basket of securities to generate additional ...

PDF Structured Products - CTBC Private Bank Fixed Coupon Note Such note features a fixed coupon paid to the investor periodically irrespective of the performance of the underlying asset. There is a callable feature whereby the Note will be redeemed earlier (autocall) if the underlying asset price is at or above the barrier/autocall level on/during any observation date/period.

PDF Contingent Coupon Notes (Autocallable) - Advisors Asset Management terms of the note. Generally, these Contingent Coupon Notes are not principal protected, and investors may lose some or all of their initial investment. Additionally, it is possible investors will not receive any coupon payments over the life of the note. Let's assume a Contingent Coupon Note has a principal barrier of 75%, observed at maturity.

Bonus Enhanced Note The note has a flat coupon of 9.18% for 6 months. That means 9.18% x 2 = 18.36 % annualised return. Investors will be entitled to the 9.18% coupon as long as all underlying stocks stay at or above entry level at the last valuation date. Bonus enhanced note is available at private banks. Requirement to open a private account is SGD2mil.

Private Lending Term Sheet: Typical Investment Terms and ... - Carofin A Summary of Terms (often called a Term Sheet) like the one described below, should be created and agreed to before you privately lend to a business. This document is the simplest way for each of the Lender and Borrower to specify the deal they are making, and a Term Sheet should be the basis upon which the other closing documents are drafted ...

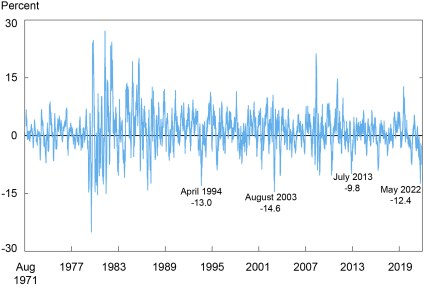

PDF Floating Rate Notes - RBC Capital Markets Floating Rate Notes (FRNs) are fixed income securities that pay a coupon determined by a reference rate which resets periodically. As the reference rate resets, the payment received is not fixed and fluctuates overtime. FRNs are in demand among investors when it is expected that interest rates will increase.

› accrued-expensesAccrued Expenses | Examples of Accrued Expenses - EDUCBA Definition of Accrued Expenses. Accrued expense is an accounting terminology under the accrual concept which states that expenses need to be recognized and recorded in an entity’s books of account during the accounting period in which they are incurred regardless of the fact whether they are been paid or not leading to simultaneous recognition of liability.

Structured Notes with Principal Protection: Note the Terms of Your ... While structured notes with principal protection have the potential to outperform the total interest payment that would be paid on typical fixed interest rate bonds, these notes also might underperform a typical fixed interest rate bond and could earn no return for the entire term of the note, even if you hold the note to maturity.

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

PDF Callable Fixed Rate Notes - RBC Capital Markets Fixed Rate Callable Notes have "fixed" interest rates for their entire term. These notes offer investors higher yields versus vanilla benchmarks. Issuer has the right to redeem the notes early in exchange for coupon payments that are potentially higher than non-structured bonds of similar credit quality. Step-Up Callable Notes

› balance-sheet-examplesBalance Sheet Examples | Explanation and Examples of ... - EDUCBA Definition of Balance Sheet Examples. Balance sheet is a key statement which forms as a part of the financial statements, which reports the financial position or the book value of the net worth of the company as at a specified date in the current year as well as the previous year, and it may be presented for a standalone entity or for the group- companies on a consolidated basis.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_Structured_Notes_Might_Not_Be_Right_for_You_Nov_2020-01-eae4f9726a074ae1b50bca26e257d429.jpg)

Post a Comment for "45 fixed coupon note term sheet"