41 coupon rate and yield to maturity

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = 5-Year Treasury Yield + .05%, So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5-Year Treasury Yield is 6.5%, then the revised coupon rate will be 7%. Yield to Maturity (YTM) - Investopedia A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon payments) to equal the current bond...

Yield to Maturity vs. Coupon Rate: What's the Difference? If an investor purchases a bond at par or face value, the yield to maturity is equal to its coupon rate. If the investor purchases the bond at a discount, its yield to maturity will be higher than...

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

Coupon rate and yield to maturity

Consider two bonds, each of which pays semiannual coupons and has five ... Plan. As in Example 6.8, we need to compute the price of each bond at 8% and 7% yield to maturities and then compute the percentage change in price.Each bond has 10 semiannual coupon payments remaining along with the repayment of par value at maturity. The cash flows per $100 of face value for the first bond are $2.50 every six months and then $100 at maturity. Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. How to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate. Since we know that the coupon rate is 5 percent, we can start by plugging numbers that are higher than that into the formula above to solve for P. [6] X Research source

Coupon rate and yield to maturity. What Is the Difference Between Coupon Rate and Yield-To-Maturity ... Coupon rate is expressed as the percentage (per annum basis) of the face value of the bond. It is the amount that the bondholders will receive for holding the bond. Coupon payments are usually made semi-annually or quarterly. Yield-to-maturity (YTM), as the name states, is the rate of return that the investor/bondholder will receive, assuming ... Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year. Coupon vs Yield | Top 5 Differences (with Infographics) Key Differences. For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield Calculation Of The Yield The Yield Function in Excel is an in-built financial function to determine the yield on security or bond that pays interest periodically. It calculates bond yield by using the bond's settlement value, maturity, rate, price, and ... Calculating The Yield Of A Coupon Bond Using Excel It let39s you so year a of- coupon with example understand- let39s for of the a rate to coupon of little yield through a An say so example bond an bond to five

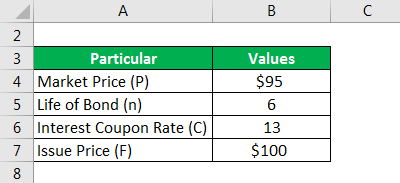

Difference Between Yield to Maturity and Coupon Rate The coupon rate is 5.25% with a term to maturity of 4.5 years. Yield to Maturity is calculated as, Yield to Maturity = 5.25 + (100-102.50/4.5) / (100+102.50/2) = 4.63%, Yield to Maturity can be identified as an important yardstick for an investor to understand the amount of return a bond will generate at the end of the maturity period. Solved Suppose a seven-year, \( \$ 1,000 \) bond with an \( | Chegg.com Expert Answer. a. Here, the coupon rate is more than the yield to maturity, so the bond is trading at a premium. b. Information provided: Par value= Future …. View the full answer. Transcribed image text: Suppose a seven-year, $1,000 bond with an 8.4% coupon rate and semiannual coupons is trading with a yield to maturity of 6.27%. a. Yield to Maturity Calculator | Calculate YTM 14.07.2022 · Determine the annual coupon rate and the coupon frequency; coupon rate is the annual interest you will receive by investing in the bond, and frequency is the number of times you will receive it in a year. In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an … Coupon Rate - Meaning, Calculation and Importance - Scripbox The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond. Let's assume the couponrate for a bond is 15%.

Yield to Maturity and Coupon Rate, The Difference - Financial Digits The yield to maturity will show the amount that you will receive if you invest in the particular bond. The coupon rate is the interest rate that is annually paid and the yield is the rate of return it generates. The coupon rate will be based on the face value of the bond. It is usually influenced by interest rates set by the Government. Yield And Coupon Rate - bizimkonak.com Coupon vs Yield Top 8 Useful Differences (with … CODES (9 days ago) 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at … Visit URL Yield to Maturity vs Coupon Rate - Speck & Company Coupon rate is the initial interest rate of a bond. The coupon rate is a fixed rate that does not change. Yield to Maturity, is the expected return of a bond if bought and held until maturity. Yield to Maturity can and often does change with time. In-depth: Coupon Rate details, Bond Yield to Maturity (YTM) Calculator - DQYDJ On this page is a bond yield to maturity calculator, to automatically calculate the internal rate of return (IRR) earned on a certain bond. This calculator automatically assumes an investor holds to maturity, reinvests coupons, and all payments and coupons will be paid on time.

How to calculate yield to maturity in Excel (Free Excel Template) 12.09.2021 · Coupon Rate (Annual): 6%; Coupons Per Year (nper): 2. The company pays interest two times a year (semi-annually). Years to Maturity: 5 years. From the time you buy the bond. Current Price of Bond (Present Value, pv): $938.40; You’re wondering whether you would invest in the bond. To make this decision, you want to know the Yield to Maturity (also called Internal …

Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per ...

When is a bond's coupon rate and yield to maturity the same? A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, ...

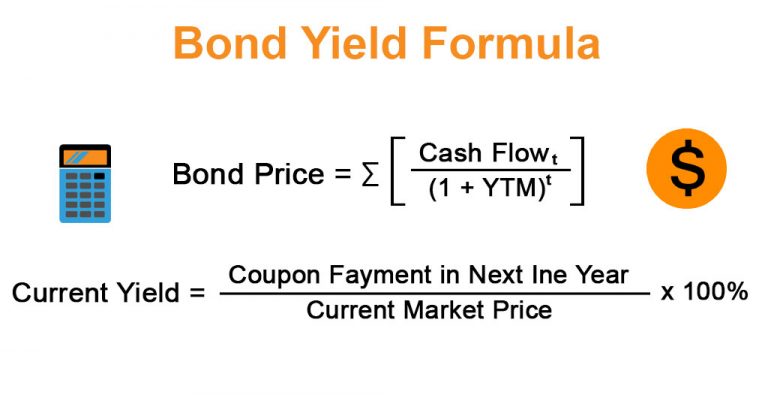

Yield to Maturity Calculator | Good Calculators C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to Maturity?

What is the difference between Coupon Rate and Yield to Maturity ... Yield formula, Let consider three scenarios, Scenario -1, Coupon rate = (10000 * 10) / 100 = 1000 (Interest Payment) Scenario -2, If the bond price is selling in discount price either because of the market fluctuation or the bond hold is willing to sell of due his emergencies.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

Post a Comment for "41 coupon rate and yield to maturity"