44 consider a bond paying a coupon rate of 10 per year semiannually when the market

› terms › pPro Rata - Investopedia Jul 18, 2022 · Pro-Rata: Pro rata is the term used to describe a proportionate allocation. It is a method of assigning an amount to a fraction according to its share of the whole. While a pro rata calculation ... Finance Archive | June 22, 2022 | Chegg.com Given that its Common Stock is currently selling at $261 per share, paying dividends of $39 per year, while the company. ... a coupon rate of 11% per year (paid semiannually), and a maturity of 13 years. F. ... The yield on a 3-month T-bill is 4% and the yield on a 10-year T-bond is 7%. The market risk premium is 5.5%, and the return on an ...

Bond selling price and yield maturity on the bond - BrainMass 4. Consider a bond paying a coupon rate of 6% per year semiannually (i.e. it pays $30 every six months) when the market interest rate at all maturities is only 2.5% per half year. The bond has three years until maturity. a. What is the bond's price today? First, you need to find the appropriate selling price by using the following formula. 0.025

Consider a bond paying a coupon rate of 10 per year semiannually when the market

IndiaBonds- Bond Details In order for that bond paying 8% to become equivalent to a new bond paying 9%, it must trade at a discounted price. Likewise, if interest rates drop to 7% or 6%, that 8% coupon becomes quite attractive and so that bond will trade at a premium to newly issued bonds that offer a lower coupon. Consider purchasing a ten-year $1000 corporate bond with an annual ... Consider purchasing a ten-year $1000 corporate bond with an annual coupon rate of $80 paid semiannually. The current market price is $992.50. Find the yield to maturity and current yield. Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The ...

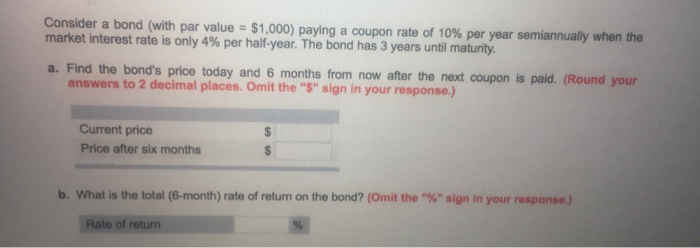

Consider a bond paying a coupon rate of 10 per year semiannually when the market. All other things equal, which of the following bond price is... ask 5 Consider a bond paying a coupon rate of 10% per year semiannually when the market interest... 1. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a) Find the bond's price today and six months from now after the next coupon is paid. Bond Price, Rate of Return, Yield to Maturity - BrainMass 7. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three year until maturity. (a) Find the bond's price today and six months from now after the next coupon is paid. (b) What is the total (six month) rate of return on the bond? 8. Bond Valuation: Formula, Steps & Examples - Study.com Horse Rocket Software has issued a five-year bond with a face value of $1,000 and a 10% coupon rate. Interest is paid annually. Similar bonds in the market have a discount rate of 12%. successessays.comSuccess Essays - Assisting students with assignments online $10.91 The best writer. $3.99 Outline. $21.99 Unlimited Revisions. Get all these features for $65.77 FREE. ... We offer the lowest prices per page in the industry ...

(Solved) - Dizzy Corp. bonds bearing a coupon rate of 12%, pay coupons ... 1 Answer to Dizzy Corp. bonds ... Yield to Maturity and Default Risk - Rate Return - Do Financial Blog 12. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total (six month) rate of return on the bond? 13. How to Price Bonds: Formula & Calculation - Study.com Steve's $1000 bond pays $100 per year, so it has a coupon rate of 10%. Investors should compare the coupon rate to the going market rate , or the interest rate most investors can expect in a ... Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually. Assuming you hold the bond to maturity, you will receive 12 coupon payments of $125 each, or a total of $1,500.

› personal-investing › helpCustomer Brokerage Account | Policies & Procedures | T. Rowe ... Bond Investing Stocks usually capture most of the headlines, but fixed income investments also represent a significant share of the financial markets. Bonds, which are long-term fixed income securities, are a significant portion of this market. › questions-and-answers › yusra-hasAnswered: yusra has a term loan that she still… | bartleby You bought a 10-year, 8% coupon bond with 7 years after it is… A: Semiannual coupon amount (C) = $40 (i.e. $1000 * 0.08 / 2) Maturity value (MV) = $1000 (Equal to par… Q: Debt will always have a cost basis. that is less than equity. What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ... How to Invest in U.S. Saving Bonds - The Motley Fool 2. Purchasing restrictions. You can buy up to $10,000 worth of Series EE bonds in any given year. Bonds come in denominations of $25 and above in penny increments. For example, per the Treasury ...

Bond Price Calculator | Formula | Chart Annual coupon rate: 5%; Coupon Frequency: Annual; Years to maturity: 10 years; Yield to maturity (YTM): 8%; The bond valuation calculator follows the steps below: Determine the face value. The face value is the balloon payment a bond investor will receive when the bond matures. For our example it is face = $1,000. Calculate the coupon per period.

Compound Interest Calculator - NerdWallet We started with $10,000 and ended up with a little more than $500 in interest after 10 years in an account with a 0.50% annual yield. But by depositing an additional $100 each month into your ...

Financial Focus: Should you own bonds when interest rates rise ... Inflation has heated up, leading the Federal Reserve to raise interest rates to help "cool off" the economy. And rising interest rates typically raise bond yields — the total annual income that investors get from their "coupon" (interest) payments. Rising yields can cause a drop in the value of your existing bonds, because investors ...

Post a Comment for "44 consider a bond paying a coupon rate of 10 per year semiannually when the market"