44 zero coupon bond journal entry

Recording Entries for Bonds - Lumen Learning The entries for the 10 years are as follows: To record bonds issued at face value. On each June 30 and December 31 for 10 years, beginning 2010 June 30 (ending 2020 June 30), the entry would be ( Remember, calculate interest as Principal x Interest x Frequency of the Year ): To record semiannual interest payment. Accounting for a non interest bearing note — AccountingTools The holder of a non interest bearing note should recognize imputed interest income on the instrument. This requires the following steps: Calculate the present value of the note, discounted based on the market rate of interest. Multiply the market rate of interest by the present value of the note to arrive at the amount of interest income.

Accounting for Convertible Bonds | Journal Entry ... Accounting record on the initial recognition: Company ABC need to make journal entry by debiting cash $ 2,00,000, credit financial liabilities $ 1,845,300 and other equity $ 154,700. Cash 2 million is the amount receive from bonds issue while the finanncial liabilities $ 1,845,300 is the present value of bonds.

Zero coupon bond journal entry

Accounting Deep Discount Bonds - CAclubindia A. Zero Coupon Bond (Deep Discount Bond) Zero-coupon bond (also called a discount bond or deep discount bond) is a bond issued at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments, or have so-called "coupons," hence the term zero-coupon bond. Zero Coupon Bond Journal Entries Pacific Zero Coupon Bond Journal EntriesSales Zero Coupon Bond Journal EntriesCredit Card P.O. Box 790441 St. Louis, MO 63179-0441 Payment Addresses Pacific Zero Coupon Bond Journal EntriesSales Zero Coupon Bond Journal EntriesCredit Card Payments P.O. Box 9001007 Louisville, KY 40290-1007 Pre-funded Coupon and Zero-Coupon Bonds: Cost of Capital ... Additional bonds are issued and proceeds are deposited in an escrow account to finance the coupon payment. Our analysis indicates that a pre-funded coupon bond is equivalent to a zero-coupon bond only if the return from the escrow account is the same as the yield to maturity of the pre-funded issue.

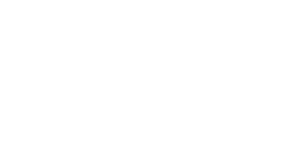

Zero coupon bond journal entry. Accounting for Issuance of Bonds (Example and Journal Entry) Coupon/Interest = $ 100,000 × 5% = $ 5,000 FV of Coupon/Interest = $ 5,000 × 4.329 = 21,645 Total Value = 78,355 + 21,645 = $ 100,000 The amortization table for the bond and its interest component is given below. ABC Company will record the journal entries for the interest payment yearly. Deferred Coupon Bond - Accountinguide Company issue 1,000 zero-coupon bonds with a par value of $ 5,000 each. As the bonds do not provide any annual interest to the investors, so they have to be discounted and pay back the full value of par value. The market rate is 5% and the term of the bonds is 4 years. Please calculate the bond price that company needs to sell to attract investors. Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... Accounting for Zero-Coupon Bonds - GitHub Pages Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000.

Zero Coupon Bond - WallStreetMojo Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. Zero coupon bond definition - AccountingTools Zero coupon bond definition January 15, 2022 What is a Zero Coupon Bond? A zero coupon bond is a bond with no stated interest rate. Investors purchase these bonds at a considerable discount to their face value in order to earn an effective interest rate. An example of a zero coupon bond is a U.S. savings bond. Disadvantages of Zero Coupon Bonds Accounting Zero Coupon Bonds Journal Entries Accounting Zero Coupon Bonds Journal Entries - Accounting Zero Coupon Bonds Journal Entries, Spirit Cruise Coupon Washington Dc, Giordano's Coupon, Baby Toys Coupons Walmart, Deals On French Lick Hotels, Jcpenney $10 Off Coupon Code December 2020, Dfds Amsterdam Deals How to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Financial Accounting - University of Minnesota Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000. Convertible zero-coupon bonds - Ask Me Help Desk Code: PV = $639 million x (1 + 0.5%)^ (-30) = $550 million which is equal to the gross proceeds that were collected, as expected. Focusing on the convertible characteristic, the conversion ratio is 9.4602 as stated. By definition, every Y dollars of Convertible Notes a bondholder receives 9.4602 shares and each share has a conversion price P. Zero Coupon Bond Journal Entries - thmc.info Zero Coupon Bond Journal Entries - Zero Coupon Bond Journal Entries, Deals Horseshoe Valley Resort, Navy Pier Winter Wonderfest Coupon Codes, Best Deals Samsung Galaxy S2 Sim Free, Free Mobile Recharge Coupons Reliance Gsm, Holiday Deals New Orleans, Joann Fabrics Coupons Printable May 2020 Bonds Payable in Accounting - Double Entry Bookkeeping Historically, bonds where issued in paper form with a coupon attached to them representing each interest payment. On the due date the bond holder would remove the coupon and exchange it at the bank for the interest payment. As the interest rate was identified on this coupon it became known as the bond coupon rate. A zero coupon bond is a bond ...

Zero Coupon Bond Issued At Discount Amortization And ... Accounting for a zero coupon bond issued at a discount (issue price less than face value) interest calculation and balance sheet recording, start with a cas...

Assume a firm issues a zero-coupon bond on 1/1/2021 ... Assume a firm issues a zero-coupon bond on 1/1/2021. The face value is $10,000,000, and the effective rate is 5.94%, compounded annually over the 40 years of the bond Make the amortization table Make the journal entry to issue the bonds on 1/1/2021 Make the entry to record interest on 12/31/2021 and 12/31/2022

Zero Coupon Bonds's Journal Entries - Svtuition Zero coupon bonds are the famous type of bonds in which the company will gives only face value without paying any extra discount. Investor g...

zero coupon bonds journal entries Book Your Lesson. jesus christ superstar john legend 2021 Office: 0800 193 76 77 or byu catering phone number Text or call: 07717 497 579

Accounting for Zero-Coupon Bonds - XPLAIND.com A zero-coupon bond is a bond which does not pay any periodic interest but whose total return results from the difference between its issuance price and maturity value. For example, if Company Z issues 1 million bonds of $1000 face value bonds due to maturity in 5 years but which do not pay any interest, it is a zero-coupon bond.

Accounting for Zero-Coupon Bonds - 2012 Book Archive Prepare journal entries for a zero-coupon bond using the effective rate method. Explain the term "compounding." Describe the theoretical problems associated with the straight-line method, and identify the situation in which this method can be applied. The Issuance of a Zero-Coupon Bond

Journal Entries of Zero Coupon Bonds - YouTube Zero coupon bonds are the famous type of bonds in which the company will gives only face value without paying any extra discount. Investor gets earning buy g...

Pre-funded Coupon and Zero-Coupon Bonds: Cost of Capital ... Additional bonds are issued and proceeds are deposited in an escrow account to finance the coupon payment. Our analysis indicates that a pre-funded coupon bond is equivalent to a zero-coupon bond only if the return from the escrow account is the same as the yield to maturity of the pre-funded issue.

Zero Coupon Bond Journal Entries Pacific Zero Coupon Bond Journal EntriesSales Zero Coupon Bond Journal EntriesCredit Card P.O. Box 790441 St. Louis, MO 63179-0441 Payment Addresses Pacific Zero Coupon Bond Journal EntriesSales Zero Coupon Bond Journal EntriesCredit Card Payments P.O. Box 9001007 Louisville, KY 40290-1007

Accounting Deep Discount Bonds - CAclubindia A. Zero Coupon Bond (Deep Discount Bond) Zero-coupon bond (also called a discount bond or deep discount bond) is a bond issued at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments, or have so-called "coupons," hence the term zero-coupon bond.

Post a Comment for "44 zero coupon bond journal entry"