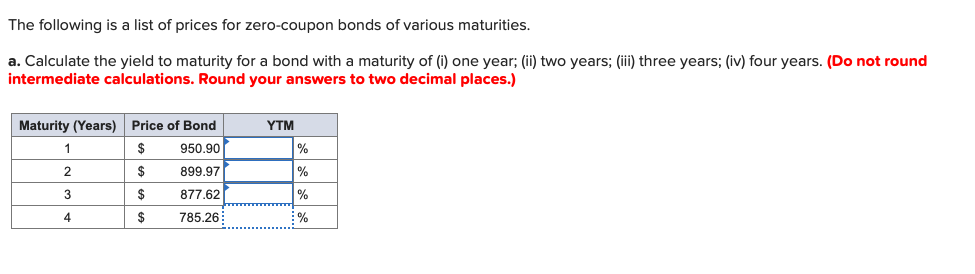

41 yield to maturity of a zero coupon bond

Yield to Maturity (YTM) Definition - investopedia.com A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon payments) to equal the current bond... Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

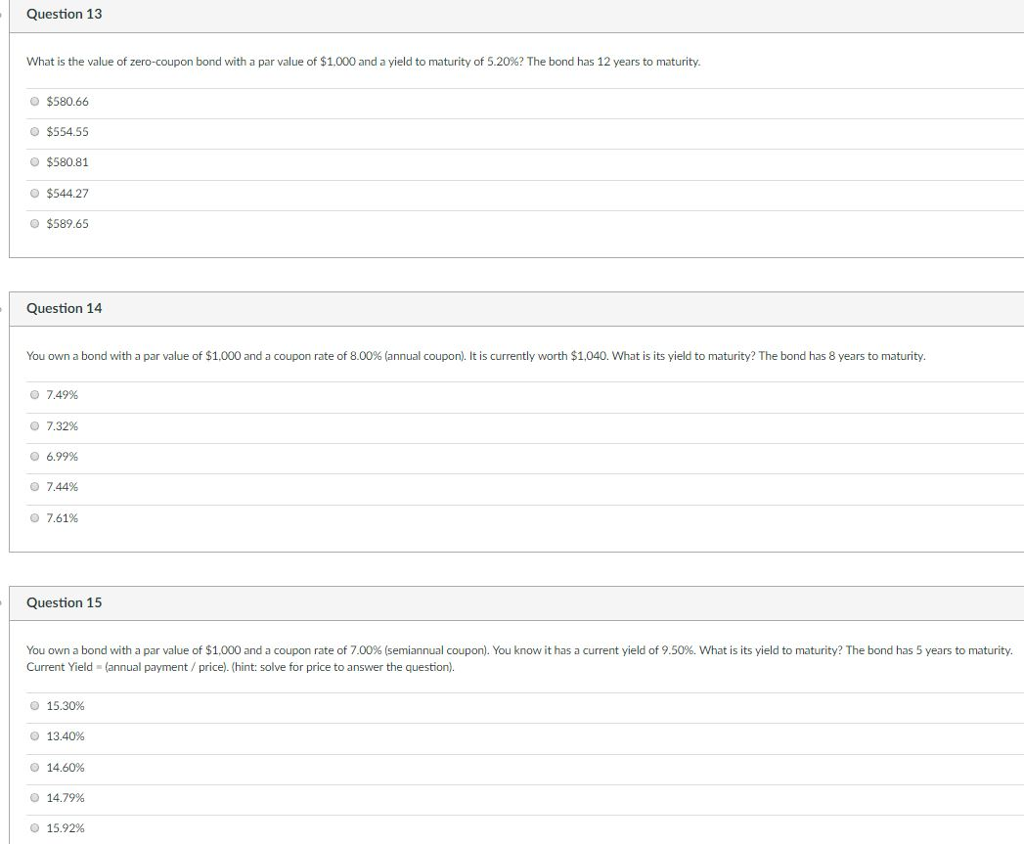

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Yield to maturity of a zero coupon bond

What is the difference between a zero-coupon bond and a ... Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax exclusion.... Solved: The yield to maturity on 1-year zero-coupon bonds ... The yield to maturity on 1-year zero-coupon bonds is currently 7%; the YTM on 2-year zeros is 8%. The Treasury plans to issue a 2-year maturity coupon bond, paying coupons once per year with a coupon rate of 9%. The face value of the bond is $100. a. At what price will the bond sell? b. What will the yield to maturity on the bond be? c. Chapter 6-Math Flashcards - Quizlet Determine the yield to maturity to the nearest tenth of 1 percent of a zero coupon bond with 8 years to maturity that is currently selling for $404. a. 11.3% b. 12.3%

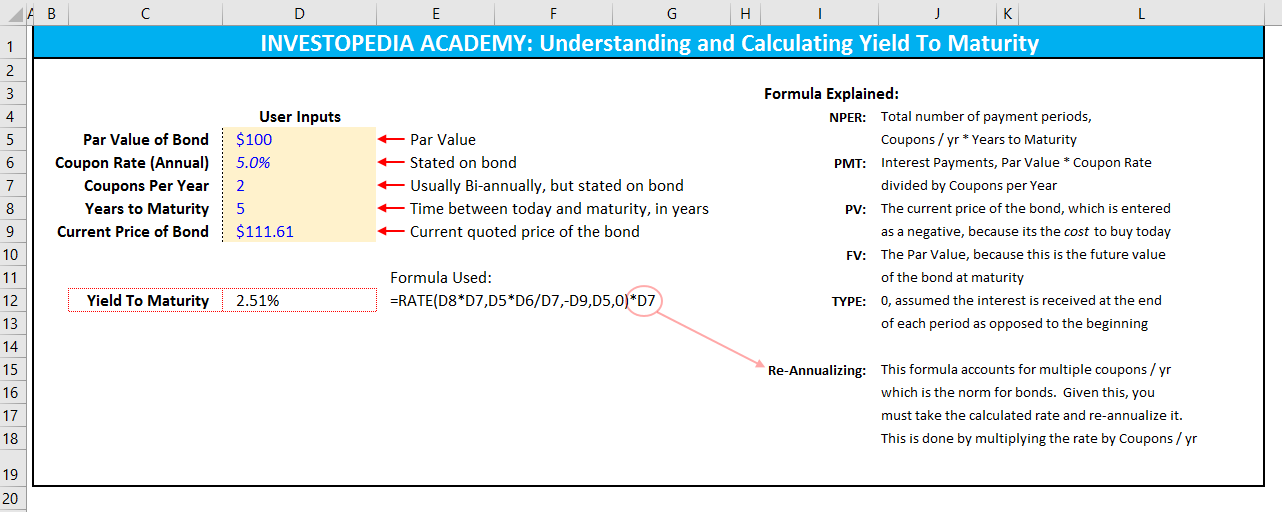

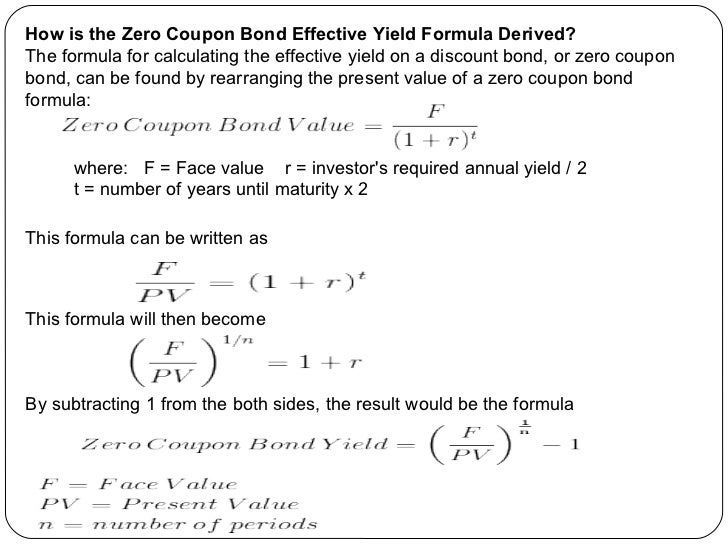

Yield to maturity of a zero coupon bond. Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top Zero Coupon Bond Yield: Formula, Considerations, and ... The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... Finance Chapter 6 Flashcards - Quizlet A) The yield to maturity of a coupon bond is a weighted average of the yields on the zero-coupon bonds. B) If the zero-coupon yield curve is downward sloping, the yield to maturity will decrease with the coupon rate. C) The information in the zero-coupon yield curve is sufficient to price all other risk-free bonds. Yield to Maturity Calculator (YTM Calculator) - YTM Formula The calculation of yield to maturity is quiet complicated, here is a yield to maturity formula to estimate the yield to maturity. Yield to Maturity (YTM) = (C+(F-P)/n)/(F+P)/2, where C = Bond Coupon Rate F = Bond Par Value P = Current Bond Price n = Years to Maturity. How to Calculate Yield to Maturity

How do I Calculate Zero Coupon Bond Yield? (with picture) Zero coupon bond yield is calculated by using the present value equation and solving it for the discount rate. The resulting rate is the yield. It is both the discount rate that is revealed by the market situation and the return rate that investors expect from the bond. The zero coupon bond yield helps investors decide whether to invest in bonds. Solved "A zero-coupon bond has a yield to maturity of 5% ... See the answer "A zero-coupon bond has a yield to maturity of 5% and a par value of $1000. If the bond matures in 5 years, it should sell for a price of __________ today. " Expert Answer 100% (1 rating) Bond price of zero coupon bond today = Matu … View the full answer Previous question Next question Yield to Maturity | Formula, Examples, Conclusion, Calculator 12.04.2022 · Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments. The YTM formula is used to calculate the bond’s yield in terms of its current market price and looks at the effective yield of a bond based on compounding. This differs from the simple yield using a goodcalculators.com › bond-yield-to-maturityYield to Maturity Calculator | Good Calculators You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate. It also calculates the current yield of a bond. Fill in the form below and click the "Calculate" button to see the results.

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. How Bond Maturity Works | Bonds | US News 12.03.2020 · A savings bond is an example of a zero-coupon bond because the interest payments are added to the bond's principal value, rather than paid out periodically. Holders can check savings bond maturity ... Yield To Maturity Calculation Method - CALKUO The constant yield method calculates the value of a zero-coupon bond at a given point of time before its maturity. The calculation is altered by estimating the time when the bond can be. A higher yield to maturity will have a lower present value or purchase price of a bond. Yield to Maturity. Solved 15, A zero-coupon bond has a yield to maturity of 9 ... 15, A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000 if the bond matures in eight years, the bond should sell for a price of A. $422.41 B. $501.87 C. $513.16 D. $483 49 today 16.

Zero Coupon Bond Calculator - What is the Market Price ... So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

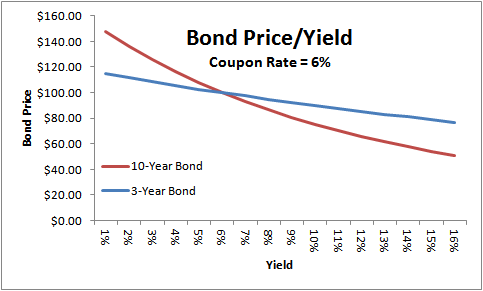

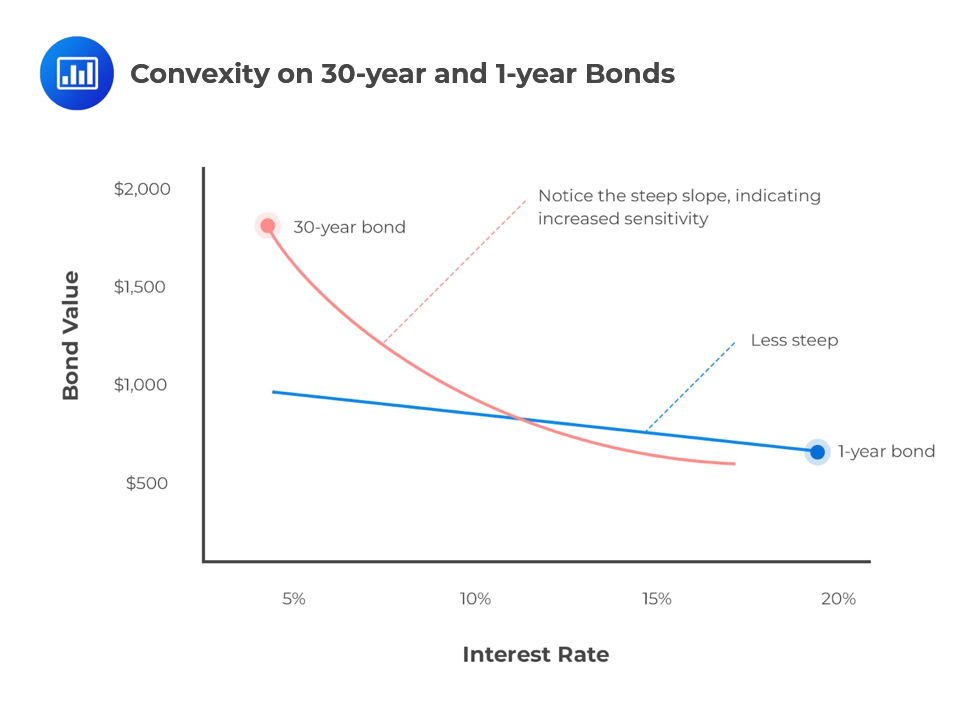

How to Calculate a Zero Coupon Bond Price | Double Entry ... As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be.

Yield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax...

Yield to Maturity (YTM) - Overview, Formula, and Importance The coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

online-calculator.org › yield-to-maturityYield to Maturity Calculator (YTM Calculator) - YTM Formula The calculation of yield to maturity is quiet complicated, here is a yield to maturity formula to estimate the yield to maturity. Yield to Maturity (YTM) = (C+(F-P)/n)/(F+P)/2, where C = Bond Coupon Rate F = Bond Par Value P = Current Bond Price n = Years to Maturity. How to Calculate Yield to Maturity

Zero coupon bond yield to maturity calculator 778066-Coupon bond yield to maturity calculator

Zero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI).. It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon.. It is called Swap because at maturity …

What’s the Difference Between Premium Bonds and Discount Bonds? - Relationship between yield to ...

Solved You find a zero coupon bond with a par value of ... You find a zero coupon bond with a par value of $10,000 and 24 years to maturity. If the yield to maturity on this bond is 4.2 percent, what is the price of the bond? Assume semiannual compounding periods. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Expert Answer 100% (20 ratings)

studyfinance.com › yield-to-maturityYield to Maturity | Formula, Examples, Conclusion, Calculator Apr 12, 2022 · Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments. The YTM formula is used to calculate the bond’s yield in terms of its current market price and looks at the effective yield of a bond based on compounding.

Solved You find a zero coupon bond with a par value of ... You find a zero coupon bond with a par value of $10,000 and 13 years to maturity. If the yield to maturity on this bond is 4.7 percent, what is the price of the bond? Assume semiannual compounding periods. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Bond price

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Value and Yield of a Zero-Coupon Bond | Formula & Example Where yield is the periodic bond yield and n refers to the total compounding periods till maturity.. Yield on a Zero-Coupon Bond. Given the current price (or issue price) of a zero-coupon bond (denoted as P), its face value (also called maturity value) of FV and total number of n coupon payments, we can find out its yield to maturity using the following equation:

You purchased a zero-coupon bond one year ago for $281.83. The market interest rate is now 9 ...

Zero Coupon Bond Calculator - MiniWebtool Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value. It is also called a discount bond or deep discount bond. Formula. The zero ...

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills. Treasury Bills (T-Bills) Treasury Bills (or T-Bills for short) are a short-term financial instrument issued by the US Treasury with maturity periods from a few days up ...

Post a Comment for "41 yield to maturity of a zero coupon bond"